41 calculating tax math worksheets

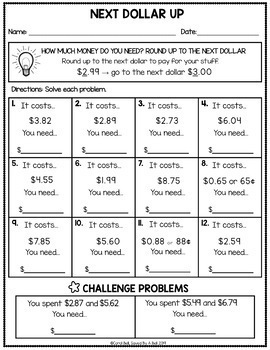

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet 2021 capital gains tax rates 2021 capital gains tax calculator 2022 capital gains tax rates In 2021 and 2022, the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a... 12 Fun Budgeting Activities PDFs for Students (Kids & Teens) Calculating Vacation Costs Worksheet Part of your prep is coming up with a list of 6 different resorts they can choose from. Students then must come up with both distance and costs when planning a trip to one of those locations, all while staying within the $4,500 budget they have. #5: Jump$tart's Reality Check Activity

Calculate Estimated Tax Payments and Associated Penalties - The Balance Calculating Your Estimated Payments Based on the tax brackets for 2022 for a single person, we can calculate your estimated income tax like this: 10% on your income up to $10,275 = $1,027 12% on your income from $10,276 through $41,775 = $3,780 22% on your income from $41,776 through $52,655 = $2,396

Calculating tax math worksheets

Calculate Percentages | A Step-by-Step Guide for Students At what percentage was his total purchase taxed? Solutions 1. The fraction is 18/20, and 20 is a factor of 100, so you can write 18/20 as the equivalent fraction 90/100 (20 x 5 = 100 and 18 x 5 = 90). This means that Andrew got 90% of the questions on his test correct. 2. Sonja did jumping jacks for six out of 15 minutes, so the fraction is 6/15. How to Calculate Gross Income Per Month - The Motley Fool For hourly employees, the calculation is a little more complicated. First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week and then multiply the total... Estimated Quarterly Tax Payments: How They Work & When to ... - NerdWallet How to calculate quarterly estimated taxes There's more than one way. Method 1 You can estimate the amount you'll owe for the year, then send one-fourth of that to the IRS. For instance, if you...

Calculating tax math worksheets. What is Annual Income? How to Calculate Your Salary How to Calculate Annual Income Generally, you can calculate your annual income with a very simple formula. Convert your hourly, daily, weekly, or monthly wages with the formula below to get your annual income. *This formula assumes you work an average of 40 hours per week and 50 weeks per year. How To Budget: Calculate Monthly Income and Expenses A well-designed budget spreadsheet will have formulas pre-programmed to add up your expenses and subtract them from your income. You can see how reducing costs 5-10 percent across small areas of your budget add up to larger savings. Resourceaholic This is where I share some of the latest news, ideas and resources for maths teachers. 1. Algebra Warm-Ups. @geoffkrall shared a year's worth of algebra warm-ups. These are designed to fit with the US curriculum where students study maths in discrete chunks, which is very different to the approach we take in the UK. TEAS 7 Practice Test (Updated 2022) 60 Questions for the ATI ... - Mometrix This has changed on the TEAS 7. The TEAS 7 features four new question types in addition to multiple-choice: Multiple-Choice: Multiple-choice questions provide four answer choices, with only one option available to select as the correct answer. In addition to text, some questions include charts, exhibits, and graphics.

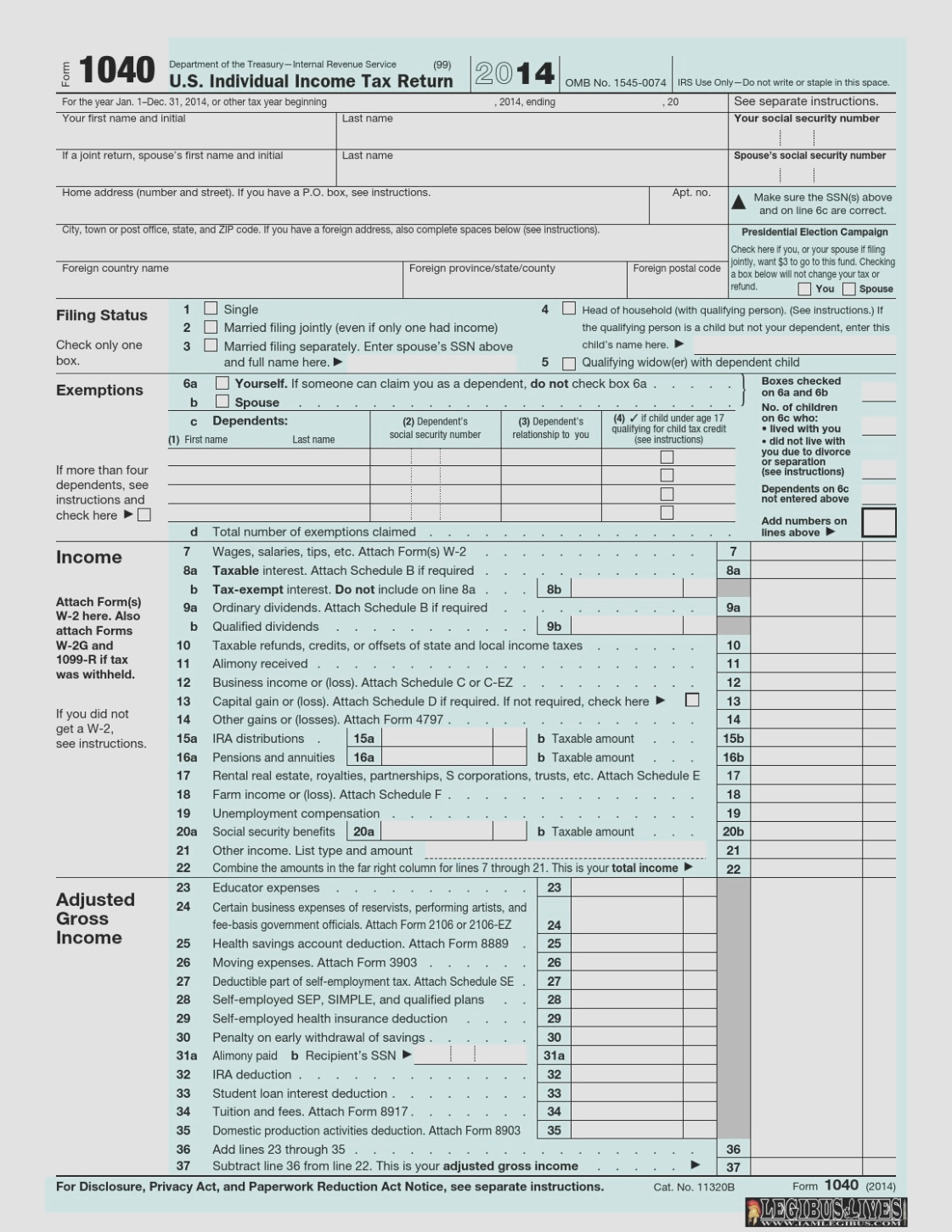

Calculating the Home Mortgage Interest Deduction (HMID) - Investopedia A taxpayer spending $12,000 on mortgage interest and paying taxes at an individual income tax rate of 35% would receive only a $4,200 tax deduction. That's slightly less than what the taxpayer... How to Calculate Payroll Taxes: Step-by-Step Instructions You can open the file to follow our calculations below. Using Worksheet 1 on page 5, we will determine how much federal income tax to withhold per pay period. Step 1. Adjust the employee's wage amount 1a) This is the same as gross wages, so as we calculated before, the amount is $2,083.33. 1b) Our employee is paid semi-monthly or 24 times per year. How Do I Calculate Estimated Taxes for My Business? You can use the estimated tax calculation worksheet provided by the IRS on Form 1040-ES or using the worksheets included in Publication 505 . Corporations usually use Form 1120-W to calculate their estimated tax. Use tax preparation software to run a rough calculation of estimated taxes for the next year. Bonus Tax Calculator | Percentage Method | Business.org The calculator on this page uses the percentage method, which calculates tax withholding based on the IRS's flat 22% tax rate on bonuses. The aggregate method, which you'll use if you pay supplemental and regular wages at the same time, is a little more complicated and requires you to check out the tax rates listed on IRS Publication 15.

United Kingdom - Individual - Sample personal income tax calculation - PwC Corporate income tax (CIT) rates; Corporate income tax (CIT) due dates; Personal income tax (PIT) rates; Personal income tax (PIT) due dates; Value-added tax (VAT) rates; Withholding tax (WHT) rates; Capital gains tax (CGT) rates; Net wealth/worth tax rates; Inheritance and gift tax rates Case interview maths (formulas, practice problems, and tips) Must-know maths formulas Revenue = Volume x Price Cost = Fixed costs + Variable costs Profit = Revenue - Cost Profit margin (aka Profitability) = Profit / Revenue Return on investment (ROI) = Annual profit / Initial investment Breakeven (aka Payback period) = Initial investment / Annual profit Free Financial Literacy Lesson Plans for High School Teachers The teaching curriculum consists of fourteen lesson plans & worksheets designed to augment a semester course in life skills and personal finance management. The Teacher's Guide, compiled in a separate, easy-to-use notebook, includes an outline of the curriculum: Goals Lesson objectives Suggested resources Teaching notes Calculating Withholding and Deductions from Paychecks The calculation for FICA withholding is fairly straightforward. 5 Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (.0765) for a total of $114.75.

Payroll tax withholding: Everything employers need to know To calculate FICA, use the following for hourly or salaried employees: For gross pay of $875.00, multiply 875 x 6.2% = $54.25 for Social Security tax. For Medicare tax, multiply $875.00 x 1.45% = $12.69. The total FICA to be withheld for this pay period is $54.25 + $12.69 = $66.94.

How to Calculate Percentage in Excel? [With Examples] Fundamentals to Calculate Percentage. Percentage formula in excel: A percentage can be calculated using the formula =part/total . Imagine you are trying to apply a discount and you would like to reduce the amount by 25%. The formula for this calculation will be =Price*1-Discount %. (Imagine the "1" as a representation of 100%.)

5 Tableau Table Calculation Functions That You Need to Know In my developer mind, what takes Tableau 8 from neat to amazing is the ability to manipulate, calculate and maneuver data quickly and easily. Calculated fields allow you to compare fields, apply aggregations, apply logic, concatenate strings, convert dates or perform a myriad of other analytical and mathematical functions on your data without needing to make changes to your database at all.

Advanced Excel Formulas - 10 Formulas You Must Know! 1. INDEX MATCH. Formula: =INDEX (C3:E9,MATCH (B13,C3:C9,0),MATCH (B14,C3:E3,0)) This is an advanced alternative to the VLOOKUP or HLOOKUP formulas (which have several drawbacks and limitations). INDEX MATCH [1] is a powerful combination of Excel formulas that will take your financial analysis and financial modeling to the next level.

How to Compute Capital Gains and Losses - Loopholelewy.com Step 1: Figure short-term (S/T) gains and losses (capital assets sold or exchanged with a holding period of one year or less). If S/T losses exceed S/T gains, you have a net S/T loss. Step 2: Figure long-term (L/T) gains and losses (capital assets sold or exchanged with a holding period of more than one year).

IRS Form 8962 - Calculate Your Premium Tax Credit (PTC) - SmartAsset Of course, using tax preparation software like TaxAct or H&R Block — or a tax accountant will simplify filling out Form 8962. But since the Premium Tax Credit is meant to help families afford health insurance, you may want to save the money and fill out the form yourself. While they seem complicated, IRS instructions are actually quite clear.

Calculation Tools | Missouri Department of Elementary and Secondary ... Revenue Estimating Tools. Basic Formula Calculation Tool for All Districts Updated 8-2-2022. Charter School Basic Formula Projection Tool Updated 2-10-2020. Summer School Estimated Revenue Calculation Tool. State Assessed Railroad and Utility Calculation Program.

What is My Tax Bracket? - TurboTax Tax Tips & Videos A tax bracket is a range of taxable income that is subject to a specific tax percentage. The brackets used to calculate your income tax depend on your filing status. In 2021 there are seven tax brackets with each one having a different tax rate ranging from 10% to 37%. For example, the brackets below show the first tax bracket if you are filing ...

Python Math: Exercises, Practice, Solution - w3resource Python Math [90 exercises with solution] [ An editor is available at the bottom of the page to write and execute the scripts.] 1. Write a Python program to convert degree to radian. Go to the editor. Note : The radian is the standard unit of angular measure, used in many areas of mathematics. An angle's measurement in radians is numerically ...

Standard Deduction: How Much Is It and How Do You Take It ... - SmartAsset Tax deductions decrease your tax burden by lowering your taxable income and you can either claim the standard deduction or itemize your deductions when you file. Prior to the 2018 tax year, the standard deductions were about half as much as they are now. Below, we cover the standard deductions for the tax year 2022, which will be filed in early ...

15 Excel Formulas, Keyboard Shortcuts & Tricks That'll Save ... - HubSpot To perform the division formula in Excel, enter the cells you're dividing in the format, =A1/B1. This formula uses a forward slash, "/," to divide cell A1 by cell B1. For example, if A1 was 5 and B1 was 10, =A1/B1 would return a decimal value of 0.5. Division in Excel is one of the simplest functions you can perform.

Estimated Quarterly Tax Payments: How They Work & When to ... - NerdWallet How to calculate quarterly estimated taxes There's more than one way. Method 1 You can estimate the amount you'll owe for the year, then send one-fourth of that to the IRS. For instance, if you...

How to Calculate Gross Income Per Month - The Motley Fool For hourly employees, the calculation is a little more complicated. First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week and then multiply the total...

Calculate Percentages | A Step-by-Step Guide for Students At what percentage was his total purchase taxed? Solutions 1. The fraction is 18/20, and 20 is a factor of 100, so you can write 18/20 as the equivalent fraction 90/100 (20 x 5 = 100 and 18 x 5 = 90). This means that Andrew got 90% of the questions on his test correct. 2. Sonja did jumping jacks for six out of 15 minutes, so the fraction is 6/15.

0 Response to "41 calculating tax math worksheets"

Post a Comment